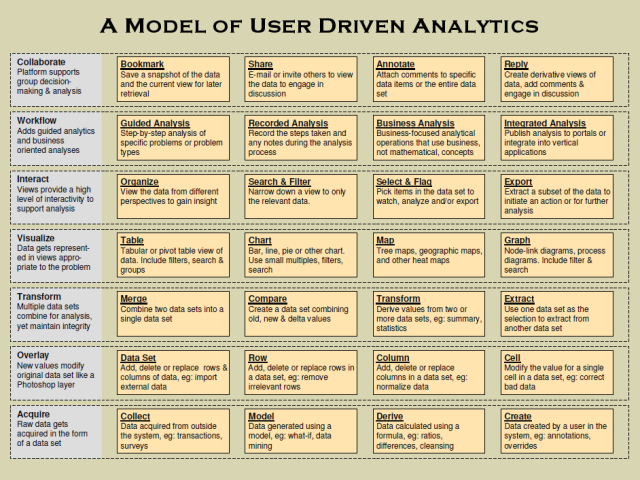

Steve Miller recently wrote an article entitled “Science of Business vs. Evidence-Based Management” in which he contrasts the hypothesis-driven philosophy of what he calls the Science of Business, which aims to support decisions by discovering business best practices using the scientific method, with the hypothesis-less philosophy of Evidence-Based Management, which aims to support decisions by looking for trends and clusters in historical data without any need to define a reason why that trend or cluster occurred.

The Science of Business he describes as a top-down approach while Evidence-Based Management he describes as bottom-up, driven only by data and not hypothesis. Steve asks whether this distinction is important for business intelligence. In this post, I argue that the distinction is important, that it applies to all decisions and not just those supported by business intelligence systems, and further attempt to define when each approach has merit.

Recent Comments